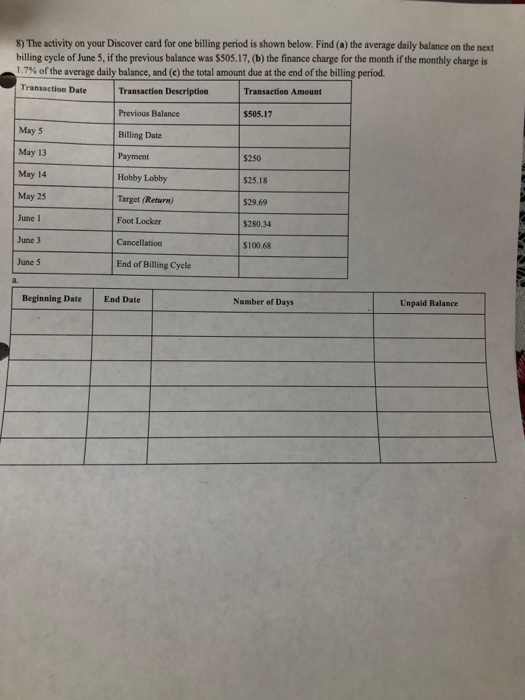

Table of ContentsGetting My What Is Derivative Instruments In Finance To WorkAn Unbiased View of In Finance What Is A DerivativeSome Known Incorrect Statements About What Do You Learn In A Finance Derivative Class Some Known Details About What Is Derivative In Finance What Does In Finance What Is A Derivative Do?

Tabulation Derivatives are instruments to manage financial dangers. Because threat is an inherent part of any investment, financial markets created derivatives as their own version of managing financial threat. Derivatives are structured as contracts and derive their returns from other monetary instruments. If the market included only easy investments like stocks and bonds, handling threat would be as easy as altering the portfolio allowance among risky stocks and safe bonds.

Derivatives are one of the ways to insure your financial investments against market variations. A derivative is specified as a monetary instrument designed to earn a market return based on the returns of another underlying possession. It is aptly called after its mechanism; as its payoff is obtained from some other monetary instrument.

It could be as basic as one party paying some cash to the other and in return, getting coverage against future monetary losses. There also could be a circumstance where no cash payment is included up front. In such cases, both the celebrations concur to do something for each other at a later date.

Every derivative commences on a particular date and ends on a later date. Normally, the reward from a specific acquired contract is calculated and/or is made on the termination date, although this can vary in many cases. As specified in the meaning, the efficiency of a derivative is reliant on the hidden possession's efficiency.

This property is sold a market where both the purchasers and the sellers equally decide its rate, and then the seller provides the underlying to the buyer and is paid in return. Spot or money rate is the price of the underlying if bought instantly. Derivative agreements can be differentiated into a number of types.

These contracts have basic functions and terms, with no personalization permitted and are backed by a clearinghouse. Nonprescription (OTC) agreements are those deals that are created by both purchasers and sellers anywhere else. Such agreements are uncontrolled and may bring the default risk for the agreement owner. Typically, the derivatives are categorized into two broad classifications: Forward Commitments Contingent Claims Forward dedications are contracts in which the celebrations guarantee to execute the deal at a specific later date at a cost concurred upon in the beginning.

Getting My What Is A Derivative In Finance Examples To Work

The underlying can either be a physical property or a stock. The loss or gain of a specific celebration is figured out by the cost motion of the property. If the price boosts, the buyer incurs a gain as he still gets to purchase the asset at the older and lower cost.

For an Go to this website in-depth understanding, you can read our special post on Swap can be defined as a series of forward derivatives. It is basically an agreement in between two celebrations where they exchange a series of money flows in the future. One party will grant pay the drifting rates of interest on a principal amount while the other party will pay a set rate of interest on the same amount in return.

Exchange traded forward commitments are called futures. A future contract is another version of a forward agreement, which is exchange-traded and standardized. Unlike forward agreements, future contracts are actively sold the secondary market, have the support of the clearinghouse, follow policies and involve a daily settlement cycle of gains and losses. There are even derivatives based on other derivatives. The factor for this is that derivatives are great at meeting the requirements of many different organisations and individuals worldwide. Futures agreements: This is an arrangement made in between two celebrations (a buyer and seller) that a product or financial instrument will be bought or cost an established price on an agreed future date.

These contracts are widely offered for lots of stock exchange indices and just about every commodity that is commercially produced including commercial and precious metals, seeds, grains, animals, oil and gas and even carbon credits. Forward agreements: These are extremely similar to futures agreements however with some important distinctions. A forward contract is tailor-made in between two celebrations and is a contract to buy or offer a property or commodity at a given rate on a provided date (what is derivative instruments in finance).

Option contracts: A choice agreement provides the agreement owner (the buyer) the right to purchase or sell a pre-determined quantity of a hidden possession. The secret here is that the owner has the right to purchase, not the commitment. They have grown quickly in popularity over the last few years and choices exist for a wide variety of underlying properties.

With a call choice, the owner has the right to purchase the hidden possession. With a put alternative, the owner has the right to offer it. Swaps: While not technically derivatives, swaps are generally thought about as such. A swap is a contract whereby 2 celebrations actually exchange, or swap, a monetary instrument's money circulation for a restricted period of time.

10 Easy Facts About Finance What Is A Derivative Explained

Unlike futures and alternatives agreements, swaps are traded non-prescription in between the parties involved and the swaps market is controlled by banks and corporations with couple of private individuals participating. Credit derivatives: This refers to one of numerous monetary instruments and strategies utilized to separate and move credit danger. The danger in question is typically that of a default by corporate or private borrowers.

Although there are lots of kinds of credit derivative, they can be broadly divided into two categories: funded credit derivatives and unfunded credit derivatives. An unfunded credit derivative is a bilateral agreement in between 2 parties and each party is accountable for completing its payments. A financed credit derivative is where the security seller (the party who is presuming the credit risk) makes a payment that is later on used to settle any credit occasions that might occur.

When it comes to an unfavorable difference taking place, the seller is paid by the purchaser. Hedging or mitigating risk. This is typically done to insure or secure versus the danger of an underlying possession. For instance, those wishing to protect themselves in case of their stock's price tumbling might purchase a put alternative.

To offer utilize. A small motion in the price of a hidden asset can produce a large distinction in a derivative's value. Choices contracts in particular are especially important in an unpredictable marketplace. When the underlying property's cost moves substantially in a more beneficial direction then the choice's worth is amplified.

This is a strategy whereby investors literally hypothesize on a possession's future cost. This is connected leverage because when investors are able to use utilize on their position (as an outcome of options agreements), they are likewise able to make big speculative plays at a fairly low cost.

Although they can allow financiers to make big amounts of money from little price motions in the underlying property, there is likewise the possibility that large losses might be made if the rate moves significantly in the other instructions. what is a finance derivative. There have been some high-profile examples of this in the previous including AIG, Barings Bank, Socit Gnrale and others.

The 2-Minute Rule for What Is Derivative Market In Finance

This is threat that emerges from the other party in financial transactions. Different derivatives have various levels of counterparty threat and some of the standardised versions are needed by law to have a quantity deposited with the exchange in order to pay for any losses. Big notional value. Famed American financier Warren Buffett as soon as explained derivatives as 'monetary weapons of mass destruction' since of the risk that their usage might develop massive losses for which financiers would be unable to compensate.

Derivatives have also been criticised for their intricacy. The various derivative techniques are so complex that they can just be executed by experts making them a hard tool for layperson to make use of. MoneyWeek has an outstanding financial investment tutorial on derivates and how you can utilize them to your advantage. See it here.

Certainly, if you were focusing in those dark days when the how to cancel bluegreen timeshare worst economic crisis since the Great Anxiety was damaging the citizens of the world, you made sure to check out and hear this mysterious word duplicated over and over. It seemed that this exceedingly complicated financial idea had practically solitarily destroyed the global economy.

More properly, what makes derivatives unique is that they obtain their value from something referred to as an "underlying." The term "underlying" ended up being a sort of shorthand to explain the kinds of monetary properties that provided the financial value upon which financial derivatives are based. These underlying monetary possessions can take many types: everything from stocks, bonds, and commodities to things as abstract as rates of interest, market indexes, and international currencies - what is a derivative finance baby terms.

This, in a sense, is what makes them so controversial and, as we learned from the monetary crisis of 2008, so unstable. While the purposes of trading derivatives are lots of and naturally complex, there are some general concepts at play in a lot of circumstances of acquired trading. The main reason investor sell derivatives is to hedge their bets against numerous financial and financial dangers.

The dangers that these financiers are attempting to prevent by using these smart financial instruments consist of things like rates of interest shifts, currency values, and credit ratings. Through intricate monetary systems, derivatives are frequently utilized to take advantage of assets. This suggests that even minor shifts in the worth of the hidden property can possibly result in enormous modifications in value for the derivative.

How What Is Derivative Market In Finance can Save You Time, Stress, and Money.

Another advantage to buying particular type of https://diigo.com/0k24f4 derivatives is that they can potentially offer the investor with a continuous stream of earnings, earnings on which the financier might not be needed to pay the capital gains tax. Some might call it gambling, but the concept of speculation with regard to derivatives is that the investor hypothesizes upon which instructions the value of the underlying property will go.

If he is inaccurate in his speculation, he still keeps the hidden worth of the possession. There are two basic "umbrella" terms that include all of the other variations of derivatives. These 2 broad categories are specified by the methods in which they are traded in the market. These classifications are over-the-counter (or, OTC) derivatives and exchange-traded derivatives.

, a practice that makes the trading procedure more fluid and the assets more liquid (pun intended). The trading process of derivatives through these clearinghouses is intricate indeed, and definitely out of the realm of this post. Suffice it to say that the exchanges are made anonymously through the clearinghouse, which ends up being a counterparty to all agreements.

As if exchange-traded acquired markets weren't puzzling enough, over-the-counter acquired markets take this intricacy to a new level. The basic concept is that the trades are negotiated and performed privately in between parties according to their individual threat choices. However there's more to it than that: these personal trades go through trade dealerships, who then trade among each other.