With a Flexi Lending, you can withdraw the needed quantity as often times as you desire, supplied you remain within the credit limit. It, hence, allows you to obtain very easy accessibility to funds at once of financial emergency situation. Better, settlements are versatile, given that you can make as numerous early repayments as you desire to during the loan repayment period.

The client withdraws money from the restriction repaired according to his needs and executes his essential jobs. In short, the greater the deposits, the minimal car loan rate of interest you'll need to pay. Typically, the majority of financial institutions charge a regular monthly fee for the maintenance of the bank account, ranging from RM5 to RM10 a month. Today, all residential or commercial https://kameronsrer316.skyrock.com/3347575316-Flexi-Individual-Funding-Flexi-Cash-Money-Check-Qualification-Rate-Of.html property Term Loans provided by the significant commercial financial institutions are Semi-Flexi by default.

- You obtain the flexibility to pay the exceptional car loan quantity as and when you want to pay, yet you require to pay the rate of interest monthly.

- Not also lengthy back, banks in Malaysia began lowering the obstacles for debtors to make added repayments to minimize the primary quantity owed.

- The largest gain from this is that the interest rate charged on the funding decreases.

- You can look for hybrid flexi lending online with the web site of the lending institution or with MyLoanCare for instantaneous authorization as well as quick disbursal of the funding quantity.

You have to be 18 or over to apply for this financing and also be fully employed with a routine, safe and secure earnings. You will be asked to verify your age and offer evidence of your earnings. Check out the company's internet site straight, or contrast various other alternatives.

To guarantee that consumers sail through the challenging situation smoothly, banks supply the Flexi-Personal Loan. Primarily, the funds taken out from your Westpac Flexi Car loan can be used for any type of purpose. Nevertheless, if you want to pay your due using the funds from your account, you have to withdraw it initially then pay face to face at any type of Westpac branch. Please remember though that if you do this, you'll still incur rate of interest on the amount that you withdraw. Get what you require from $3,000 and utilize it for a variety of objectives. You can check your rates of interest prior to using with no impact to your credit report.

Bottom Lines To Think About With The Westpac Flexi Financing

Finder.com.au has accessibility to track information from the item issuers listed on our sites. Although we offer information on the products used by a wide variety of providers, we do not cover every readily available service or product. These include the nature of the car loan, interest rate, procedure of disbursal, tenor and the repayment mode. As banks and banks supply Flexi lendings to their old customers.

A completely Flexi car loan is one that allows a customer to require out as well as put in cash to the funding account as and when the client pleases without sustaining any type of additional charges or treatments. This is usually attained by linking accountancy to the car loan. Where our site links to particular products or displays 'Most likely to website' switches, we might receive a compensation, reference cost or settlement when you click on those buttons or get an item. Thanks for your question and for getting in touch with finder.com.au-- a monetary contrast website and general details service designed to help consumers make much better decisions. We do not stand for Westpac or any banks we include on our web page.

Standard Term Lending Non

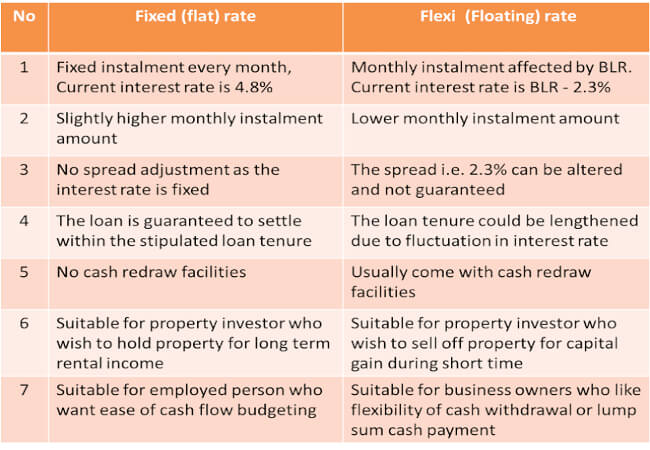

With the standard term funding you have assurance understanding how much precisely you have to spend for your home loan on a month-to-month basis. While there is absence of flexibility to a fundamental term car loan, you may be able to obtain a reduced home loan interest rate when compared to the semi-flexi lending or flexi lending. By allowing you to make breakthrough payments on your home loan quantity, the semi-flexi loan will certainly minimize your funding passion since the major amount has actually been lowered. Plus, going with a semi-flexi car loan enables you to withdraw added amounts that you have actually paid above the established settlement schedule.

Yes, Financial Institution of China Malaysia has actually lately presented its Flexi Real estate Loan product that incorporates a Current Account with Home Loan to make it less complicated for you to plan your repayment. What makes this loan strategy terrific is that it'll aid you to minimize rate of interest. Today, not all banks provide Full Flexi property lending choices. Most of the residential or commercial property car loans in the market are variable interest rate financings, wherein the interest rate is linked to the base price of financial institutions. Make an application for a financing from anywhere in India just by responding to some questions on the website or app. These details will be used to evaluate the qualification for the business funding.

In standard personal car loans, the accepted loan amount is disbursed in a single payment. At the same time, in a Flexi car loan, you can not go beyond a borrowing limit. It makes certain that you are borrowing only the quantity you need, offering you control over your lending. To compute their settlement with month-to-month installations, flexi personal loan consumers can calculate their EMIs utilizing the Flexi individual lending EMI calculator. For the calculation, one should get in the finance quantity he/she wants to make use of as well as the possible interest rate.